Overlook Halloween ghosts, these charts scare Wall Road | US & Canada Information

This year it hardly takes the ghosts and ghouls of Halloween to make it scary for investors.

They saw the fastest bear market ever, a similarly spectacular rebound, and now hobble through late October, with stocks surging wildly again. Thank you for the resurgent virus, a slowing economic recovery, and the US presidential election for that.

Still on the sidelines with the calendar set to the past two months, Wall Street is most terrified of these charts:

Steve Chiavarone, portfolio manager and equity strategist at Federated Hermes

With the 2020 mail-in voting potentially reaching more than 40-50% of the vote due to historical patterns, we saw over 1 million ballots rejected in the upcoming election, essentially three times as many as four years ago. This could be the deciding factor in major battlefield states. There is a risk here that we will receive a controversial election that will extend into December and will ultimately be decided by the courts. In the meantime, the market should grapple with greater political and economic uncertainty, while negotiations on fiscal incentives are pushed into the background until the new government is seated in late January.

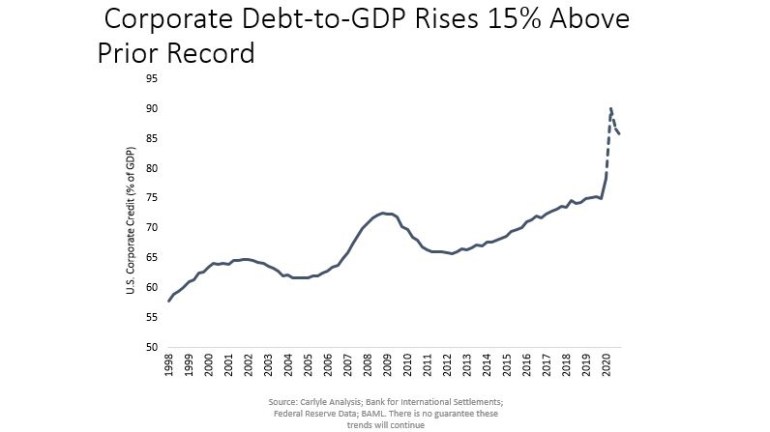

Jason Thomas, Head of Global Research at Carlyle Group

Corporate debt in the US reached an all-time high relative to GDP in 2020. Taking into account the additional debt issued in 2020 and the offsetting of restructuring, this rate should increase by a further 15% this year. Effective debt service ratios remain at 2001 levels – and above those in 2009 – when senior debt default rates reached 8%. Instead of a sharp peak and then a rapid decline, default rates could remain at elevated levels for an extended period of time, simply moving the defaults that would otherwise have occurred in 2020 into the future.

Evan Brown, Head of Multi-Asset Strategy at UBS Asset Management

The rolling 63-day correlation between gold and the S&P 500 index was positive for the vast majority of 2020. This means that gold may no longer be a reliable ballast for portfolios during pauses in risk triggered by concerns about the threat to economic activity. We attribute this dynamic to the strong correlation between gold and real rates, in line with current stance and outlook for monetary policy.

Ben Emons, General Manager, Macro Strategy, Medley Global Advisors

The Covid-19 crisis resulted in vaccine companies trading at a historic premium to the S&P as well as the Nasdaq and stay-at-home or reopening sectors. The risk is that a vaccine could fail and geopolitical tensions hampered its spread. Vaccine companies will sell, and while their market weight in major indices is lower than that of tech or industrial industries, the performance of vaccine stocks in 2021 can be watched on their impact on major global stock indices.

Gina Martin Adams, Chief Equity Strategist at Bloomberg Intelligence

I would consider policy / tax reform to be Wall Street’s biggest fear for 2021 right now, even though it depends somewhat on the elections. The other points I would consider is the outlook for the dollar, especially given the federal budget deficit and concentration of profits in the tech space, as well as fears of a recurrence of the tech bubble.

Peter Tchir, Head of Macro Strategy at Academy Securities

US real returns are the worst in the past two decades. Some might argue that the dollar weakness is good and a competitive advantage, but the structural dollar weakness affects me, especially when we expect record amounts of government bonds to be issued. The German real returns are now “competitive” with ours. Since the European debt crisis, our nominal returns for Europe have looked attractive, but so have our real returns. Will this real interest rate differential prove to be a major source of government bond purchases? This diagram “scares me” because I don’t have a good idea of what it really means and the implications it might have while not many people are discussing it.

Marlena Lee, Head of Investment Solutions and former Co-Head of Research at Dimensional Fund Advisors

In March, ghostly investors fled the equity and bond markets, with money market inflows totaling $ 684 billion. That was terribly bad timing. For the six-month period from April 1 to September 30, global equities and fixed income securities returned 29.54% and 3.16%, respectively. It’s scary to think about the implications that will affect the financial well-being of many savers.

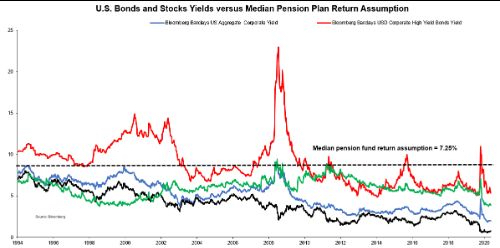

Vincent Deluard, Director of Global Macro Strategy at StoneX Group Inc.

U.S. pension funds estimate that they earn 7.25% of their portfolio by mixing assets that averaged less than 3% return. Even if pension funds were to invest solely in the highest-yielding asset (junk bonds), they would still miss their target by about 200 basis points while taking a risk that would violate their fiduciary duties. There has to be something: either asset prices will drop sharply to restore normal expected returns (which would trigger an instant solvency crisis for most pension funds) or pension funds will “die of a thousand cuts” because there are no viable reinvestment opportunities. In either case, most pension plans will fail to meet their contractual obligations.

Liz Ann Sonders, Chief Investment Strategist at Charles Schwab Corp.

Although wage increases since the April low reflect the hiring of temporarily unemployed Americans, the sustained surge in permanent job losses and the rise in the duration of unemployment are evidence of the detrimental longer-term effects of the virus on the economy.

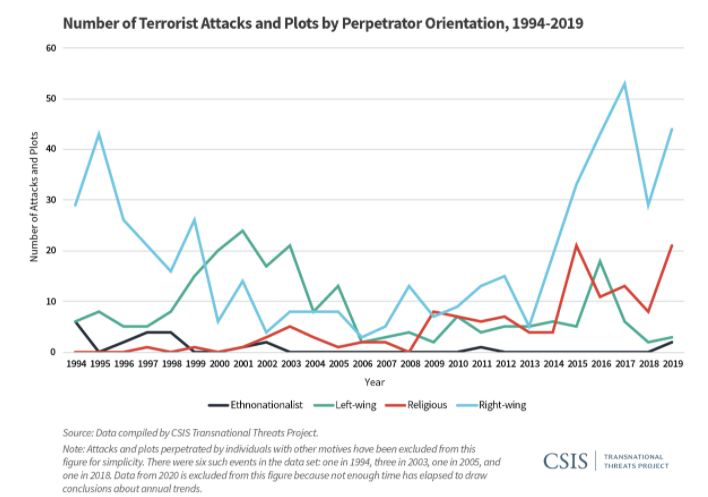

Benn Eifert, Chief Investment Officer of the hedge fund QVR Advisors

I used to be an economist in emerging markets. The biggest differences are that at DM we take the rule of law and lack of social / political violence for granted. In the past four years we have seen extreme polarization and encouragement and normalization of political violence in the US and it is appalling where that could go if it is not scrutinized.

Lauren Goodwin, economist and multi-asset portfolio strategist at New York Life Investments

The labor force participation in prime age has fallen since the beginning of the Covid crisis and has undermined the progress of the last expansion. After an initial rebound, participation has fallen again, suggesting that measures in support of US policies have not anchored people in their jobs. The resulting frictions in the labor market are likely to affect economic recovery, exacerbate income inequality and have long-term effects on economic growth and financial stability.

Chris Murphy, co-lead derivatives strategy at Susquehanna International Group

The VIX closed above $ 40 for the first time in more than 90 days. This has happened ten times since 1990, and the S&P 500 has fallen an average of another 1.1% two weeks later. More scary? The Russell 2000 fell an average of 4.7% two weeks later.

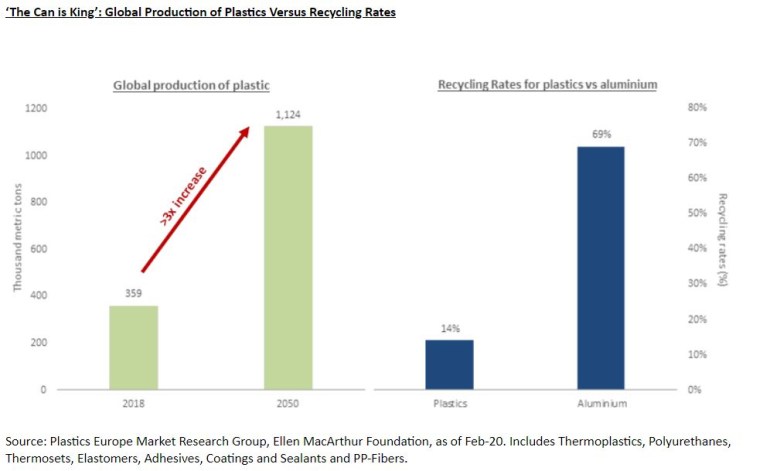

Katie Koch, Co-Head of Fundamental Equity at Goldman Sachs Asset Management

According to current forecasts, global plastics production will more than triple by 2050, after having doubled in the last ten years. In contrast, 75% of all aluminum ever produced in human history is still used today, with the global recycling rate for aluminum beverage cans being 69%. While much remains to be done to achieve a more environmentally sustainable growth model – advances in biodegradable and easier-to-recycle plastics are an integral part of this transition – the reality for now is: “The can is king.”

(Bloomberg)

(Bloomberg)

Comments are closed.