Nasdaq jumps most since April, Bitcoin soars above $54,000 | Monetary Markets Information

The rising prospects for turbocharged US economic growth have rearranged the winners and losers in the stock market over the past two months.

Investors flocked back into the riskiest assets in the market on Tuesday as dip buyers drove the Nasdaq 100 into its biggest rally since April, sending Bitcoin back to a record. Treasuries added to profits after a banknote auction.

Stay-at-Home winners rose after being believed dead as vaccinations spiked and the Democrats grossed $ 1.9 trillion in the economy. Government bond yields pulled back from recent highs triggered by concerns that a possible overshoot of the economy could bring inflation. For at least one day, the rotation from growth shares to value was violently reversed. Here are some of the most important steps:

- Tesla Inc. was up nearly 20% on its best day since the start of the year.

- Peloton Interactive Inc., DocuSign Inc., and Pinduoduo Inc. grew more than 11%.

- Financial companies and energy producers, the recent winners, were the only two S&P 500 groups to pull out.

- Spot gold rose more than 2% after falling to its lowest level since April.

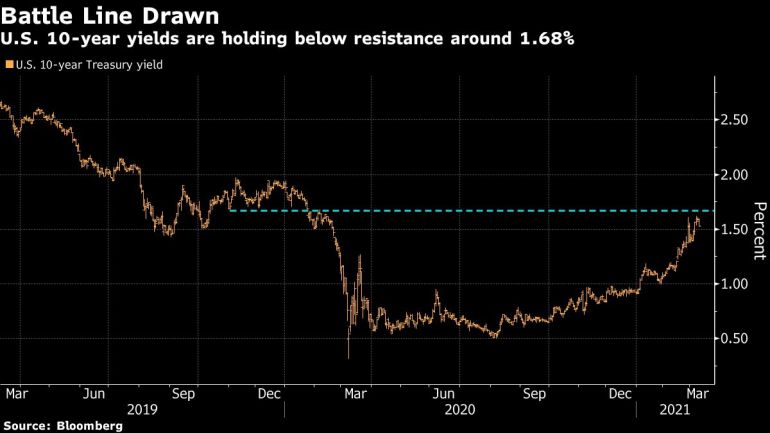

- The 10 year return fell below 1.55%.

- Bitcoin jumped over $ 54,000.

- Oil and copper retreated after the recent rallies.

The rising prospects for turbo-charged economic growth have rearranged the winners and losers of the market over the past two months as the stimulus package became more likely and daily vaccinations increased. On Tuesday, Dip shoppers rated the recently abandoned areas as overpriced. The reverse has been a theme that has been played for years, every retreat is bought and it has been extreme lately. The S&P 500 has not seen a 5% decline since November.

The decline in government bond yields following the recent violent surge has given risk takers some coverage to return to growth after leaving the group as stretched valuations have become frightening amid rising interest rates.

“Let’s not forget that less than a year ago, traders interpreted one of the biggest negative macro events in market history as a buying opportunity. Given the positive signals that surround us today, there is little reason to think otherwise,” said Chris Larkin, Managing Director trading and investing products at E * Trade Financial. “Corrections create natural turning points for traders. It is no surprise that the Nasdaq is rising today, and fundamentals are supporting the ongoing bullish move. “

The first of several Treasury sales in the coming days went without disrupting the markets. The sales will test the appetite for the safest debt after last month’s poorly bid auctions shocked world markets and short bets rose to a record high. The benchmark’s 10-year returns exceeded 1.6% levels to trade at a one-year high last week.

Here are some key events to watch:

- The report on EIA crude oil inventories is due on Wednesday

- February’s consumer price index for the US provides the latest update of Wednesday’s price pressures.

- The US government is auctioning 3-, 10-, and 30-year government bonds this week.

- The European Central Bank is holding its monetary policy meeting and President Christine Lagarde will hold a briefing on Thursday.

Stocks

- The S&P 500 index gained 1.9% from 3:30 p.m. New York time.

- The Nasdaq 100 gained 4.6%.

- The Stoxx Europe 600 Index gained 0.8%.

- The MSCI Asia Pacific Index rose 0.8%.

- The MSCI Emerging Market Index rose 0.9%.

Currencies

- The Bloomberg Dollar Spot Index was down 0.6%.

- The euro gained 0.5% to USD 1.1902.

- The British pound rose 0.5% to $ 1.3897.

- The Japanese yen rose 0.4% to 108.46 per dollar.

tie up

- The 10-year government bond yield fell five basis points to 1.54%.

- Germany’s 10-year rate of return fell by three basis points to -0.30%.

raw materials

- West Texas Intermediate Crude Oil fell 1.6% to $ 64.02 a barrel.

- Gold futures gained 2.2% to $ 1,715.30 an ounce.

Comments are closed.